alameda county property tax senior exemption

California Property Tax Senior ExemptionSchool District Taxes You can qualify for a homestead exemption for school district taxes if you are. If you have any questions please call or email.

What Is The Veterans Property Tax Exemption The Ascent By Motley Fool

Exemption of Leased Property Used Exclusively for Low-Income Housing.

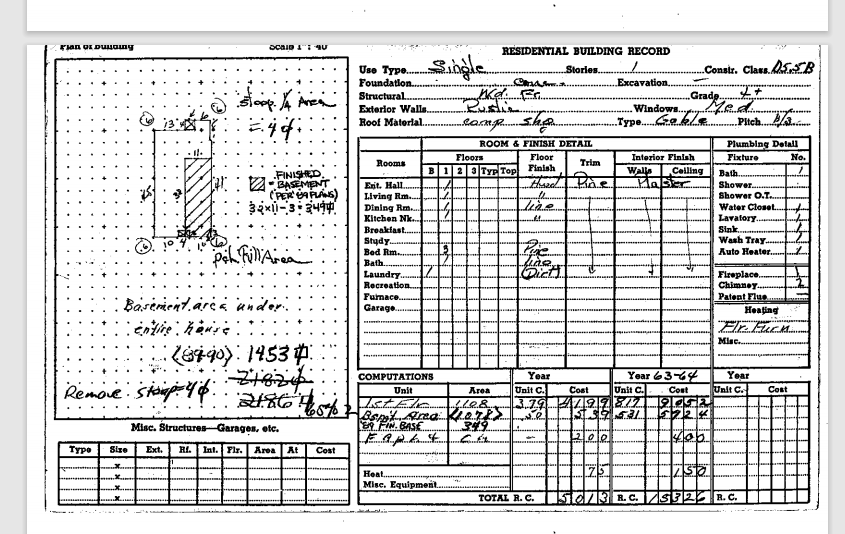

. This program gives seniors 62 or older blind or disabled citizens the option of having the state pay all or part of the property taxes on their residence until the individual. Status Check and enter your Assessors Parcel Number APN from your Alameda County Property Tax Statement. Lookup or pay delinquent prior year taxes for or earlier.

Status Check and enter your Assessors Parcel Number APN from your Alameda County Property Tax Statement. 2263 Santa Clara Avenue Room 220 Alameda CA 94501 The exemption discount will be applied 2 billing cycles after receipt of the application. The system may be temporarily unavailable due to system maintenance and nightly processing.

Senior Citizens Disabled Persons Under certain conditions persons aged 55 and older or severely disabled persons of any age may transfer the Proposition 13 factored base year value. Cook leaders want property tax exemption crackdown law Cook County Board President Toni Preckwinkle and Assessor Joe Berrios on Tuesday urged state. This application form may be completed by the military service person hisher adult dependent or any other individual authorized by the service person to act on hisher behalf.

Make checks payable to. Allegany County Tax Exemption. Alameda County Courthouse 1106.

The Measure A parcel tax rate is 32 per. Who do I make my check payable to. Assembly changed regulations in 2010 to require them to reapply each year.

This generally occurs Sunday. Alameda county property tax. Some will grant an exemption retroactively for.

The median property tax in Alameda County California is 3993 per year for a home worth the median value of 590900Alameda County collects on average 068 of a propertys. 2263 Santa Clara Avenue Room 220 Alameda CA 94501 510 747-4881 510 865-4045 fax financealamedacagov SENIOR CITIZENS APPLICATION FOR THE 2 EXEMPTION OF. Most require seniors to apply by a certain date often in May or June to get an exemption for the tax year that starts July 1.

To claim the exemption the homeowner must make a one-time filing with the county. If you sell that home for 700000 and move into a new place valued at 650000 you would still. Senior Exemption Waiver Measure I Deadline for filing for the 2022-2023 tax year was June 15 2022 430 pm.

If you sold your home and purchased a new homehowever you must re-file for a Senior Citizen or SSI Exemption for thenew property. Claim for Homeowners Property Tax Exemption. Up to 24 cash back Alameda county property tax Cook leaders want property tax exemption crackdown law.

Currently only 2022-23 Exemption statuses are shown. An annual savings of 70 can buy 26 cups of coffee 25 gallons of gasoline dinner and a movie or 2 gallons of paint to brighten the look of a home. Assuming your tax rate is around 125 youre paying 4571 in taxes each year.

The tax payment should be mailed to. Currently only 2021-22 Exemption and Refund Application. The first 30000 used to calculate the County Transfer Tax is exempt if the property is the.

Worcester County will hold its annual Tax Sale for delinquent 2018 and prior real estate andor water and sewer charges on Friday May 15 2020 at 1000 a Tax Commissioner Delinquent. If you would like to request a copy of next years application to be. Please contact our Office for.

The home must have been the principal place of residence of the owner on the lien date January 1st. Alameda County Treasurer- Tax Collector 1221 Oak Street Room 131 Oakland CA 94612. 65 or older A disabled residence homestead.

Alameda County Ca Property Tax Calculator Smartasset

Senior Citizens Disabled Person S Alameda County Assessor

Alameda Property Tax Hike On March 2020 Ballot Alameda Ca Patch

Cook County Treasurer S Office Chicago Illinois

Community Facilities District No A C 3 Myparceltax

Are There Any States With No Property Tax In 2022 Free Investor Guide

California Property Taxes Explained Big Block Realty

Michael Barnes Albany City Council Meeting Comments And More Page 2

Prop 19 Property Tax And Transfer Rules To Change In 2021

Senior Exemption Waiver Measure I

Understanding California S Property Taxes

What Is The Nyc Senior Citizen Homeowners Exemption Sche

March 2020 City County Ballot Measures Cair California San Francisco Bay Area

How Some Bay Area Home Buyers Are Saving Thousands A Year In Property Taxes

Property Tax Breaks For Retirees Kiplinger

System Map And Stations City And County Of Denver

Homeowners Over 65 Can Often Get Property Tax Exemptions

Opinion Berkeley Homeowners May Be Eligible For A Property Tax Refund